A call option is a financial contract that gives the buyer the right, but not the obligation, to buy an underlying asset at a specified price on or before a certain date. The underlying asset can be a stock, bond, commodity, or other financial instrument. The specified price is called the strike price. The date on which the option can be exercised is called the expiration date.

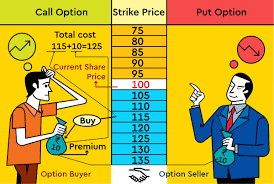

The buyer of a call option pays a premium to the seller of the option. The premium is the price of the option. If the underlying asset price is above the strike price on the expiration date, the buyer can exercise the option and buy the asset at the strike price. This gives the buyer a profit, because they can then sell the asset at the higher market price.

If the underlying asset price is below the strike price on the expiration date, the buyer will not exercise the option and will lose the premium they paid. However, they will not be obligated to buy the asset at the strike price.

Call options are a popular way to speculate on the price of an underlying asset. If the buyer believes that the price of the asset will go up, they can buy a call option. If the price of the asset does go up, the buyer will make a profit. However, if the price of the asset goes down, the buyer will lose the premium they paid.

Call options can also be used to hedge against risk. If the buyer owns an underlying asset, they can buy a call option to protect themselves against the risk of the asset price going down. If the price of the asset does go down, the buyer can exercise the option and buy the asset at the strike price. This will protect the buyer from losing money on the asset.

Call options are a complex financial instrument, and there are many risks associated with them. However, they can also be a profitable way to speculate on the price of an underlying asset or to hedge against risk.

Here are some additional things to know about call options:

- The price of a call option is determined by a number of factors, including the strike price, the expiration date, the volatility of the underlying asset, and the interest rates.

- Call options can be traded on exchanges, such as the Chicago Board Options Exchange (CBOE).

- Call options are a leveraged instrument, which means that they can amplify profits or losses.

- It is important to understand the risks associated with call options before trading them.