What lies ahead for the Indian currency?

The story earlier: The rupee slumped on Friday to a record closing low of 75.20 against the U.S. dollar as deepening concerns about the economic fallout of the COVID-19 pandemic sent global investors scurrying to dump most assets, especially emerging market holdings, and opt for cash and the relative safety of the greenback. The rupee has now depreciated by more than 5.3% in 2020, with the bulk of its losses, a 4.1% slide, having occurred in March.

Why is the Indian currency weakening?

Just as it happened in 2008 during the Global Financial Crisis (GFC), the widespread economic uncertainty triggered by the latest COVID-19 outbreak has forced most investors and businesses across the world to look up to conserve that most crucial asset during times of crisis: cash and more specifically the U.S. dollar. The dollar strengthened about 22% against the Euro as enterprises, especially in the world‘s largest economy, hoarded the U.S. currency in 2008.

In the start of the month, overseas investors have dumped Indian equities and debt on a scale not seen since the taper tantrum of 2013, when news that the U.S. was dropping to gradually wind down its GFC-triggered quantitative easing spurred an exodus out of emerging market assets. As on March 20, foreign institutional investors (FIIs) had sold a net ₹95,485 crore, or more than $12 billion, of shares and bonds. This outflow has coincided with the sharp fall in the equity market‘s key gauge, the 30-stock S&P BSE Sensex, which has slumped 22% so far in March.

What else is contributing to the fall?

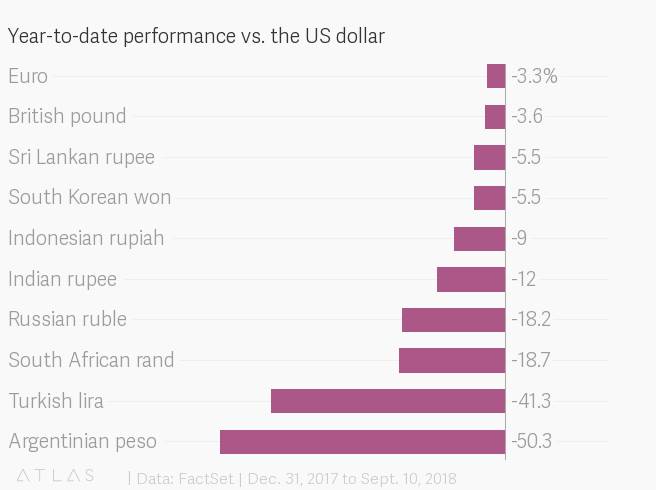

The rupee‘s decrease in March has been part of a broad trend as most currencies across the globe have weakened against their U.S. counterpart. The dollar index, which gauges the greenback’s strength against a basket of six currencies, has gained almost 4% so far this month. The risk aversion as a result of the pandemic triggered by the global outbreak of COVID-19 has been so intense that it has not spared most perceived safe havens including U.S. Treasuries (government bonds) and significantly even gold. The yellow metal too has been sold by investors looking to hold the most liquid and most fungible of all assets — the U.S. dollar.

Where does the rupee go from here?

Given that the increasing possibility of the global economy heading into a recession has been a key driver of the dollar‘s appreciation against other currencies, including the rupee, there is clearly more pain ahead for the Indian currency. And it is the fact that India’s own domestic economy has been struggling to reverse an extended slowdown — with both private consumption and investment by businesses substantially becalmed — and it is hard to see sentiment on the rupee improving appreciably in the short-term.

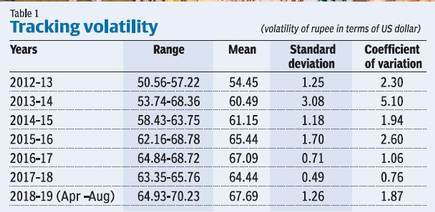

However, a few offsetting factors offer just a little comfort. For one, India‘s foreign exchange reserves are still at a fairly robust level and as on March 13 amounted to a total of almost $482 billion. Armed with this war chest, the Reserve Bank of India (RBI) has stepped in every now and then, both to smooth volatility in the foreign exchange market and to ensure that a sudden shortage of dollar supply does not exacerbate the weakening trend in the rupee. The central bank, in fact, last week provided $2-billion of dollar liquidity through a forex swap on Monday, and is set to provide a similar line on March 23 as well.

Also, the price of oil, which is one the largest contributors to India‘s import bill, has dramatically declined this month with Brent crude oil futures having slumped more than 46% to $26.98 as on March 20. With nor Saudi Arabia nor Russia appearing to be in any hurry to de-escalate their price war, and energy demand likely to remain depressed in the foreseeable future on account of the global economic downturn, oil may remain one source of respite for the rupee.

And were the U.S. economy itself to go beyond a recession and possibly head for a massive unemployment featuring depression — if more States join California in enforcing severe movement curbs such as the wide coastal State‘s statewide “stay-in-place” order to contain the spread of the viral pandemic —the dollar too could become a risky holding.

Still, to complicate matters on the outlook, the RBI is most likely to cut interest rates in the very near future to support the sagging economy at this juncture, a move that could potentially again add to the downward pressure on the rupee.