Excise Duty: What Is It and Which Goods Are Subject to It?

Excise duty is a type of indirect taxation levied by the government on certain types of goods, including alcohol, tobacco, petrol and diesel, and can also include certain types of entertainment such as gambling. In some countries, the term 'excise' may also be used to refer to any duties or taxes charged on goods, including customs duties and other taxes.

Excise duty is a tax levied by the government on specific goods produced or imported into a country. The main purpose of this tax is to generate revenue for the government; however, it can also be used to control the production, supply, and use of these particular goods. This taxation system is most commonly seen in countries where there is a significant production and consumption of those goods.

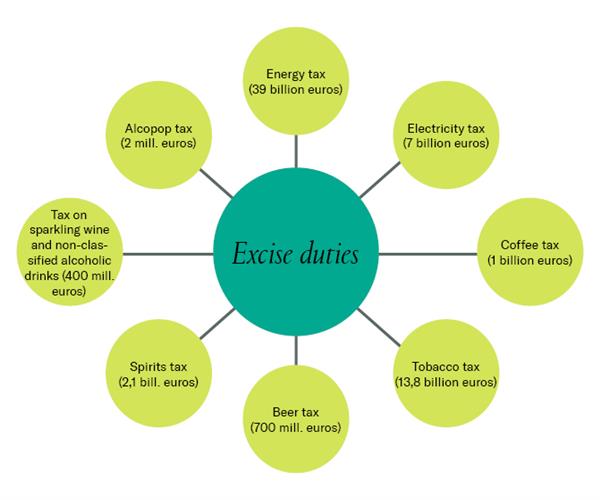

The types of goods subject to excise duty vary according to each country's laws, but the most common goods include alcoholic beverages, tobacco, petrol and diesel, and entertainment services, such as gambling. In some countries, the tax rate may be different depending on the type of goods, or even the strength or quantity of the goods.

In addition to the tax charged on these goods, certain excise duties may also be applied to the sale or consumption of these goods. For example, alcohol and tobacco may be subject to an additional excise tax when sold in retail outlets. Similarly, in some countries, a tax may be charged on the purchase of petrol and diesel, or on the consumption of gambling services.

The revenue generated from excise duty taxes goes to the government and is usually used to fund public services, such as education and infrastructure. However, some countries may also use the revenue from these taxes to reduce the overall tax burden on their citizens.

Excise duty taxes are an important source of revenue for governments, but they can also be used to influence people's behaviour. For example, taxes on alcohol and tobacco are often used to discourage people from drinking and smoking. Similarly, taxes on petrol and diesel are used to discourage people from using vehicles with a high carbon dioxide output.

CONCLUSION

However, excise duty can be controversial, as some people argue that it unfairly targets certain groups. For example, they argue that the tax is regressive, meaning that it disproportionately affects poorer people. In addition, taxes can be complex, hard to understand, and difficult to avoid. Despite its potential drawbacks, excise duty remains an important tool for governments to raise revenue and control the production and sale of certain products. As such, it is likely to remain an important part of the taxation system for the foreseeable future.

In conclusion, excise duty is a type of indirect taxation levied by the government on certain types of goods, including alcohol, tobacco, petrol and diesel, and entertainment services, such as gambling. The purpose of this tax is to generate revenue for the government, as well as to discourage people from using certain products or services.