The Great Depression was an overall monetary wretchedness that kept going 10 years. Its kickoff was "Dark Thursday," October 24, 1929. That is when merchants sold 12.9 million offers of stock in multi day, triple the standard sum. Throughout the following four days, stock costs fell 23 percent in the share trading system crash of 1929.

By its tallness in 1933, joblessness had ascended from 3 percent to 25 percent of the country's workforce. Wages for the individuals who still had employments fell 42 percent. U.S. TU.S. total national output was sliced down the middle, from $103 billion to $55 billion. That was mostly a result of flattening. Costs fell 10 percent every year. Froze government pioneers passed the Smoot-Hawley duty to ensure residential ventures and occupations. Therefore, world exchange dove 65 percent as estimated in U.S. dollars. It fell 25 percent in the aggregate number of units.

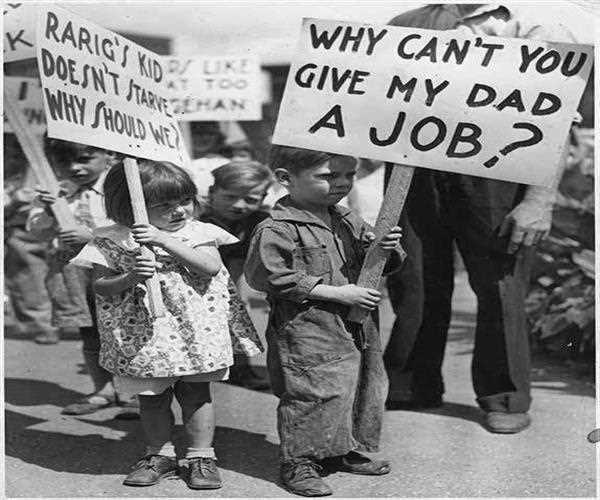

Life During The Depression

The Depression made numerous ranchers lose their homesteads. In the meantime, long stretches of over-development and dry spell made the "Tidy Bowl" in the Midwest. It finished horticulture in a formerly prolific district. A large number of these ranchers and other jobless laborers searched for work in California. Numerous wound up living as destitute "homeless people." Others moved to shantytowns called "Hoovervilles," named after then-President Herbert Hoover. What Caused It

As indicated by Ben Bernanke, the past administrator of the Federal Reserve, the national bank made the Depression. It utilized tight financial arrangements when it ought to have done the inverse. Bernanke featured the Fed's five basic mix-ups.

The Fed started raising the fed reserves rate in the spring of 1928. It continued expanding it through a subsidence that began in August 1929.

At the point when the stock exchange slammed, financial specialists swung to the money markets. Around then, the highest quality level upheld the estimation of the dollars held by the U.S. government. Examiners started exchanging their dollars for gold in September 1931. That made a keep running on the dollar.

The Fed raised loan fees again to safeguard the dollar's esteem. That further confined the accessibility of cash for organizations. More insolvencies took after.

The Fed did not build the supply of cash to battle emptying.

Financial specialists pulled back the entirety of their stores from banks. The disappointment of the banks made more frenzy. The Fed disregarded the banks' situation. This circumstance demolished any of shoppers' residual trust in budgetary establishments. The vast majority pulled back their money and put it under their beddings. That further diminished the cash supply. The Fed did not put enough cash available for use to get the economy going once more. Rather, the Fed permitted the aggregate supply of U.S. dollars to fall 30 percent.

"Cheers"