Overview:

A few nations gather a lot of obligation for different reasons, including financial strategy, outer shocks, and strategy issues in their economies. Elevated degrees of obligation can strain a nation's economy, compelling its capacity to put development and improvement on the edge. Understanding the reasons for high public obligation can give insight into potential arrangements and counteraction methodologies.

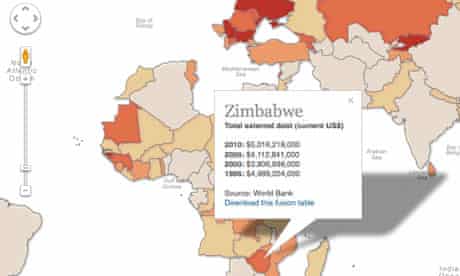

|<img data-img-src='https://i.guim.co.uk/img/static/sys-images/Business/Pix/pictures/2012/5/4/1336129940861/Debt-and-the-developing-w-008.jpg?width=300&quality=45&auto=format&fit=max&dpr=2&s=0d73f421700e271be50a0c0517ee0041' alt='Why do some countries have high debt' /><p><br><br><strong>Monetary arrangements</strong></p><p><br><br> Government use over income is the primary driver of high obligations. At the point when nations are in steady shortage, they need to get cash to back the shortfall. These credits can emerge from homegrown and global banks, permitting them to amass after some time. Expansionary financial strategies, for example, enormous scope foundation or social government assistance programs, can add to high obligation in the event that they are not oversaw as expected.</p><p><br><br><strong>Open air shock</strong></p><p><br><br> Nations may likewise cause significant obligation because of outer shocks, for example, an unexpected fall in item costs, cataclysmic events, or a worldwide downturn, or these occasions might diminish government incomes and raise obligation since the need has expanded. For instance, oil-trading nations might confront greater expenses when oil costs fall, lessening send out income.</p><p><br><br><strong>Interest and acquiring costs</strong></p><p><br><br> Higher loan fees can raise acquiring costs, accelerating the amassing of obligations. Nations with great credit scores will more often than not face higher loan fees while giving bonds or acquiring them, expanding their obligation levels. Over the long run, the expense of the obligation can turn into a huge piece of a nation's spending plan, adding more obligation.</p><p><br><br><strong>Design data</strong></p><p><br><br> Primary issues like expense framework shortcomings, defilement, and the absence of monetary adaptability can likewise add to greater expenses. Nations that depend on independent companies or commodities might be more helpless against monetary changes, prompting more prominent requirements for credit. Also, unfortunate administration and failures in the utilization of assets can prompt expanded shortages and expenses.<br><br><br> </p><p><br> High <a href=">

|<img data-img-src='https://i.guim.co.uk/img/static/sys-images/Business/Pix/pictures/2012/5/4/1336129940861/Debt-and-the-developing-w-008.jpg?width=300&quality=45&auto=format&fit=max&dpr=2&s=0d73f421700e271be50a0c0517ee0041' alt='Why do some countries have high debt' /><p><br><br><strong>Monetary arrangements</strong></p><p><br><br> Government use over income is the primary driver of high obligations. At the point when nations are in steady shortage, they need to get cash to back the shortfall. These credits can emerge from homegrown and global banks, permitting them to amass after some time. Expansionary financial strategies, for example, enormous scope foundation or social government assistance programs, can add to high obligation in the event that they are not oversaw as expected.</p><p><br><br><strong>Open air shock</strong></p><p><br><br> Nations may likewise cause significant obligation because of outer shocks, for example, an unexpected fall in item costs, cataclysmic events, or a worldwide downturn, or these occasions might diminish government incomes and raise obligation since the need has expanded. For instance, oil-trading nations might confront greater expenses when oil costs fall, lessening send out income.</p><p><br><br><strong>Interest and acquiring costs</strong></p><p><br><br> Higher loan fees can raise acquiring costs, accelerating the amassing of obligations. Nations with great credit scores will more often than not face higher loan fees while giving bonds or acquiring them, expanding their obligation levels. Over the long run, the expense of the obligation can turn into a huge piece of a nation's spending plan, adding more obligation.</p><p><br><br><strong>Design data</strong></p><p><br><br> Primary issues like expense framework shortcomings, defilement, and the absence of monetary adaptability can likewise add to greater expenses. Nations that depend on independent companies or commodities might be more helpless against monetary changes, prompting more prominent requirements for credit. Also, unfortunate administration and failures in the utilization of assets can prompt expanded shortages and expenses.<br><br><br> </p><p><br> High <a href=">

Monetary arrangements

Government use over income is the primary driver of high obligations. At the point when nations are in steady shortage, they need to get cash to back the shortfall. These credits can emerge from homegrown and global banks, permitting them to amass after some time. Expansionary financial strategies, for example, enormous scope foundation or social government assistance programs, can add to high obligation in the event that they are not oversaw as expected.

Open air shock

Nations may likewise cause significant obligation because of outer shocks, for example, an unexpected fall in item costs, cataclysmic events, or a worldwide downturn, or these occasions might diminish government incomes and raise obligation since the need has expanded. For instance, oil-trading nations might confront greater expenses when oil costs fall, lessening send out income.

Interest and acquiring costs

Higher loan fees can raise acquiring costs, accelerating the amassing of obligations. Nations with great credit scores will more often than not face higher loan fees while giving bonds or acquiring them, expanding their obligation levels. Over the long run, the expense of the obligation can turn into a huge piece of a nation's spending plan, adding more obligation.

Design data

Primary issues like expense framework shortcomings, defilement, and the absence of monetary adaptability can likewise add to greater expenses. Nations that depend on independent companies or commodities might be more helpless against monetary changes, prompting more prominent requirements for credit. Also, unfortunate administration and failures in the utilization of assets can prompt expanded shortages and expenses.

High

debt in some

countries is in many cases brought about by a mix of money related strategy, outside shocks, higher borrowing costs, and primary variables. To address these difficulties, cautious monetary administration, monetary expansion, improved administration, and adaptability are expected to decrease weakness in outer elements.

Read more: What is the national debt