An overview-Marshall court:

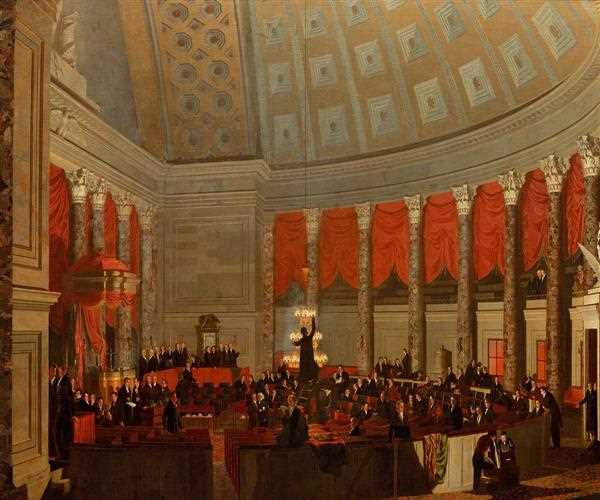

The Marshall Court refers to the United States Supreme Court from 1801 to 1835. It was when John Marshall served as the fourth Chief Justice. Marshall performed the duties of the Chief Justice of the United States until his death, after which Roger Taney was appointed to take office.

John Marshall

The Marshall Court, led by John Marshall, played a significant role in multiplying the powers of the judicial branch, as well as the management of the national government. In a survey of lawyers and jurists performed in 1930, Marshall was nominated as the most extraordinary Chief Justice in the entire history of America.

John Marshall was a strong nationalist with a Hamiltonian view of the Constitution. He established the supremacy of national legislation over state laws. Most of his decisions favored manufacturing and business interests and advanced economic development.

Some people believe that the Marshall Court was in charge of upholding the sanctity of several contracts like the Fletcher v. Peck, the Yazoo Land Fraud case in 1810.

Also read: How did the mass production of cars affect the American economy?

Initiatives taken by John Marshall:

Marshall also emphasized the precedence of federal power over the state authorities, and in McCulloch v. Maryland (1819), the Court declared the constitutionality of the Second Bank of the United States. The Constitution bestowed specific powers on Congress and the lesser authority necessary for carrying out the specified powers.

The specific power to levy taxes implies that Congress was granted the necessary powers required to accomplish the creation of a depository (bank) or, later, the result of the Internal Revenue Service.

Also read: What did staying neutral during world-war I do for the American economy?