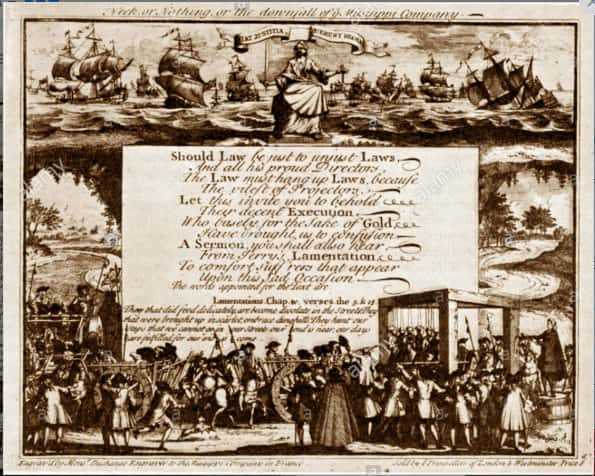

*Mississippi Scheme*

Mississippi Bubble, a money-related plan in the eighteenth century France that set off a theoretical craze and finished in the budgetary crumple. The plan was designed by John Law, a Scottish globe-trotter, monetary scholar, and money related wizard who was a companion of the official, Duke d'Orléans. In 1716 Law built up the Banque Générale, a save money with the expert to issue notes. After a year he set up the Compagnie d'Occident ("Company of the West") and got for it elite benefits to build up the tremendous French domains in the Mississippi River valley of North America. Legal organization likewise soon hoarded the African slave exchanges and French tobacco, and by 1719 the Compagnie des Indes ("Company of the Indies"), as it had been renamed, held a total syndication of France's pioneer exchange. Law likewise assumed control over the gathering of French duties and the printing of cash; as a result, he controlled both the nation's outside exchange and its funds.

Given the potential for benefits included, open interest for shares in the Compagnie des Indes expanded pointedly, sending the cost for an offer from 500 to 18,000 lives, which was out of all extent to income. By 1719 Law had issued around 625,000 stock offers, and he soon a short time later consolidated the Banque Générale with the Compagnie des Indes. Law would have liked to resign the immense open obligation collected amid the later years of Louis XIV's rule by pitching his organization's offers to general society in return for state-issued open securities, or billets d'état, which thusly additionally climbed strongly in esteem. A free for all of the wild theory resulted in that prompted a general securities exchange blast crosswise over Europe. The French government exploited this circumstance by printing expanded measures of paper cash, which was promptly acknowledged by the state's loan bosses since it could be utilized to purchase more offers of the Compagnie. This went ahead until the point that the over the top issue of paper cash animated running expansion, and both the paper cash and the billets d'état started to lose their esteem. In the meantime, the normal benefits from the organization's frontier wander were eased back to emerge, and the complicated connecting of the organization's stock with the state's accounts finished in entire calamity in 1720, when the estimation of the offers dove, causing a general securities exchange crash in France and different nations. Despite the fact that the crash was not straightforwardly owing to Law, he was the undeniable substitute and was compelled to escape France in December 1720. The colossal obligations of his organization and bank were soon a short time later united and assumed control by the state, which brought charges up keeping in mind the end goal to resign it.

Cheers!