Foreign direct investment in India is the measure monetary source for economic development in India.Foreign company invest directly in fast growing private Indian businesses to take benefits of cheaper wages and changing business environment of India.Economic liberalization started in India in wake of the 19 91 economic crisis and since that FDI has steadily increased in India. It was Manmohan Singh and PV Narasimha Rao who got FDI in India which subsequently generated more than 1 crore jobs. In 2015 India over to China and the US as the top destination for the foreign direct investment. 2016/2017 in first half of the 2015, India attracted investment of $ 31 million compared to $28 million and d$ 27 million of China and the US respectively. For a country where foreign investment are being made it also with achieving technical know how and generating employment

The Indian government’s favorable policy regime and robust business environment have ensured that foreign capital keeps flowing into the country. The government has taken many initiative in recent years such as relaxing FDI norms across sectors such as defenses, oil refineries ,Telecom power exchanges, and stock exchanges among others.

GOVERNMENT INITIATIVES

In September 2017, the Government of India ask the state to focus on strength in single window clearance system for Fast tracking approval processes, in order to increase Japanese investments in India.The ministry of Commerce and industry, Government of India has East approval mechanism for foreign direct investment FDI proposal by doing away with the approval of department of Revenue and mandating clearance of our proposal requiring approval within 10 weeks after the receipt of applications.

India and Japan has joined hands for infrastructure development in India’s north eastern state and I also setting up an Indian Japan co-ordination forum for development of Northeast to undertake strategic infrastructure projects in the North East.

The Government of India is in talks with stakeholder to for the ease of foreign direct investment(FDI) in defense under the automatic route to 51% from the current 49%, in order to give a boost to the make in India initiative and to generate employment.In January 2018 hundred percent FDI was allowed in single brand retail through automatic route along relaxation in rules in other areas.

The Central Board of Direct taxes (CBDT)has exempted employees stock options(ESOPs foreign direct investment and court approved transaction from the long term capital gains Tax under the finance act 2017.

The Government of India is likely to allow hundred percent foreign direct investment in cash and ATM management companies, since they are not required to comply with the private security agencies Regulation Act (PSARA).

ROAD AHEAD

India has become the most attractive emerging market for global partners investment for the coming 12 months, as per our recent market attractiveness survey conducted by emerging market private equity Association.

The World bank has stated that private investment in India is expected to grow by 8.8% in final year 2018 -2019 to overtake private consumption growth of 7.4% , and thereby drive the growth in India Gross Domestic Product GDP in final year 2018 to 2019.

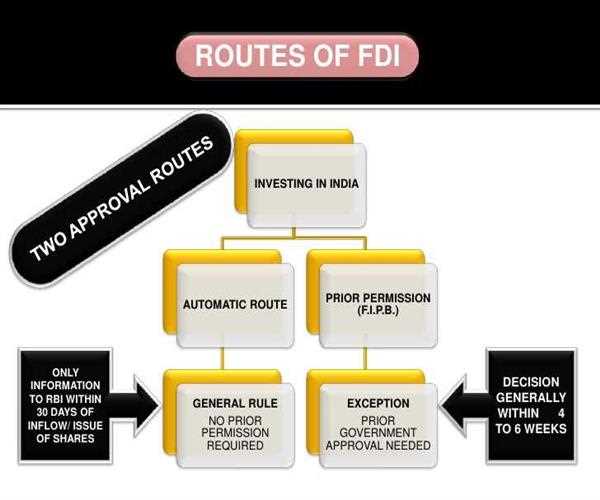

INDIA GETS FDI BY ROUTES

• AUTOMATIC ROUTE: By this route FDI is allowed without prior approval by government for Reserve Bank of India

• GOVERNMENT ROUTE : prior approval by government is needed we have this route application need to be made through for investment facilitation portal which will facilitate single window clearance of FDI application under approval route the application will be forwarded to the respective Ministries which will act on the application as per the standard operating procedure

.

Foreign investment promotion board was script by the union government, the work relating to processing of application for FDI and approval of the government their own under the extant FDI policy and FEMA, shall now be handed by the concerned Ministries/ department in consultation with the department of industrial policy and promotion, minister of Commerce, which will also issue the standard operating procedure for processing of application and decision of the government under the extant FDI policy

INFRASTRUCTURE

10% of India’s GDP is based on construction activity. Indian government has invested $1 trillion on infrastructure from 2012-2017. 40% of this $ 1 trillion had to be funded by private sector. 100% percent FDI under automatic route is permitted in construction sector for cities and townships.

MANUFACTURING.

India’s making progress turning itself into a magnet form in manufacturers, the aim being to increase the share of manufacturing in India GDP from stagnant 15 to 16% since 1980 to 25% by 2022 and create an additional 100 million jobs.Electronics contributes to India’s success in manufacturing but some challenges remain with foreign direct investment.

INVESTMENT/DEVELOPMENT

Foreign investment into an internet entity on a strategic basis is subject to RBI policy the department of industrial policy and promotion formulate a consolidated FDI policy on a daily basis which is defined Framework for FDI.

INVESTORS

Foreign investor can invest directly in India, either on their own or throw joint ventures in virtually all the sector except in a very small list of activities where foreign investment is prohibited.

FDI in majority of the sector is under automatic route, that is allowed without any requirement of seeking regulatory approval prior to such investment .Eligible investor can invest in post of the sectors of Indian economy on an automatic basis.

• ANY NON-RESIDENT INDIVIDUAL : NRI can invest subject to FDI policy NRI resident it and citizen of Nepal and Bhutan are permitted to invest on repatriation basis(amount of consideration for such investment shall be paid only by way of inward remittances through normal banking channels

• Company, trust or partnership firm

• Foreign institutional investors and foreign portfolio investors.

• SEBI registered for venture capital investors

HOPE THIS IS INFORMATIVE.