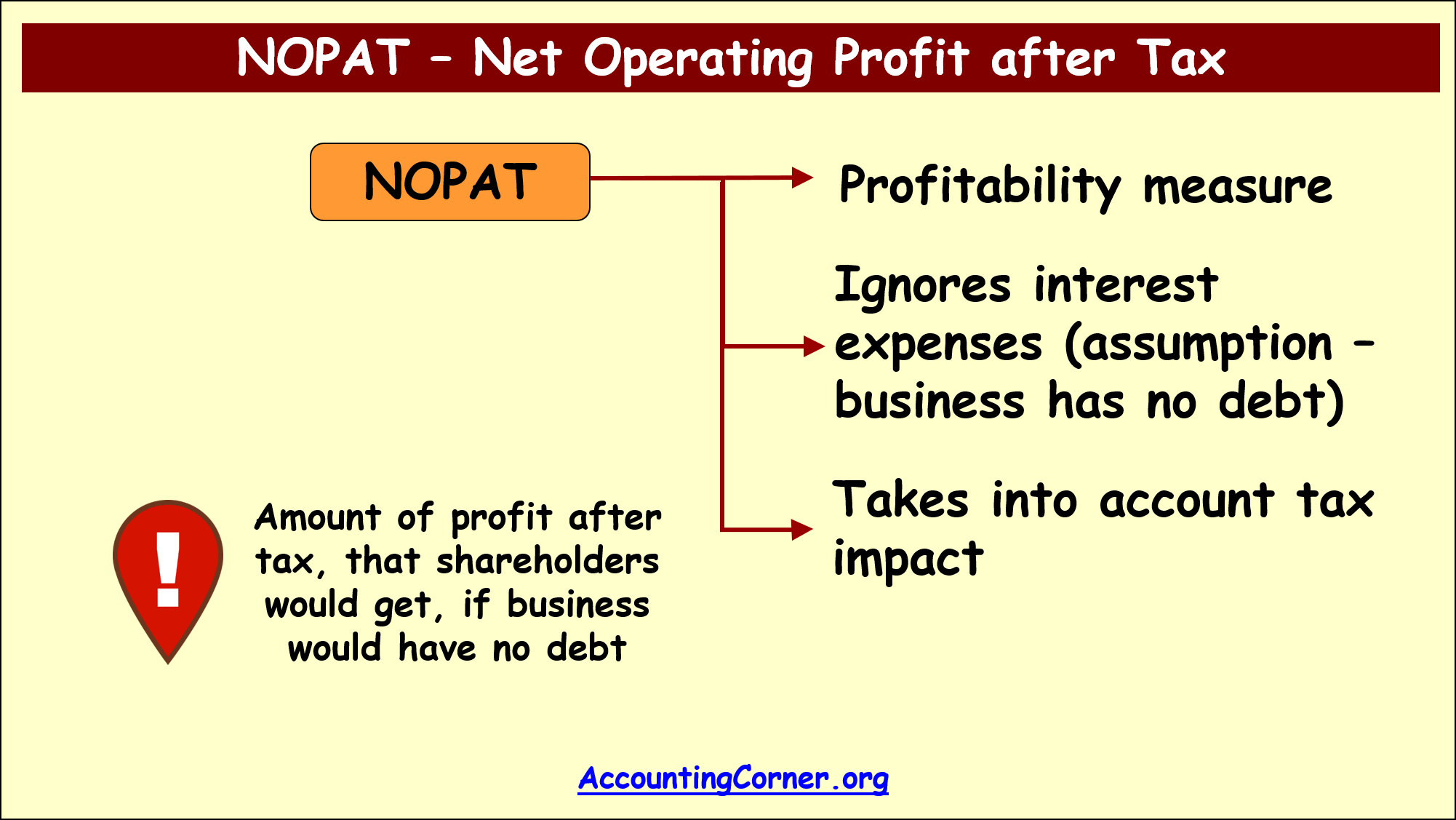

NOPAT, or net working benefit after duty, is a monetary measurement used to assess the productivity of an organization's center working exercises subsequent to representing charges. It gives a more clear image of an organization's functional proficiency by barring the effect of interest and expenses.

Overview:

- Calculation:

NOPAT is determined by deducting charges from an organization's working benefit. The equation is communicated as follows:

NOPAT=OperatingProfit×(1−TaxRate)

Working benefit, otherwise called working pay or EBIT (Income Before Interest and Expenses), addresses an organization's benefit from its center tasks before interest and charges are deducted.

- Center around center activities:

NOPAT centers only around an organization's working benefit, barring the impact of monetary influence (interest) and expenses. Because of this, NOPAT is a useful metric for determining the company's capacity to profit from its primary business operations.

- Comparison of Businesses:

NOPAT considers more significant correlations of benefit between organizations, as it gives a normalized measure that isn't impacted by contrasts in charge rates or monetary designs.

- Financial Backer Examination:

Financial backers frequently use NOPAT to assess an organization's actual working presentation and proficiency. It gives a premise to surveying the organization's capacity to produce benefits from its center business, which is pivotal for long-haul maintainability.

- Valuation Measurements:

Financial metrics like Economic Value Added (EVA) and Return on Invested Capital (ROIC) frequently incorporate NOPAT. These measurements survey an organization's financial benefit and effectiveness in using capital.

- Limitations:

For a comprehensive analysis, it is essential to take into account NOPAT in conjunction with other financial metrics. Moreover, it may not represent varieties in charge regulations or exceptional monetary designs among organizations.

In rundown, NOPAT is a key metric that assists financial backers and examiners with surveying an organization's functional productivity by zeroing in on center business exercises. By killing the effect of interest and expenses, NOPAT gives a more clear perspective on an organization's capacity to create benefits from its continuous tasks.

Read more: What are the best practices for BYOD (Bring Your Own Device) in business