The types of orders that are issued during equity trading are referred to as 'Trade Order'

Placing an order at the stock is not limited to just 'Buy' and 'Sell'...it undergoes various types of tracking between the expected price of the order and the price at which it was actually fixed.

It is important to place some stock market order limit for continuous monitoring of your particular order.

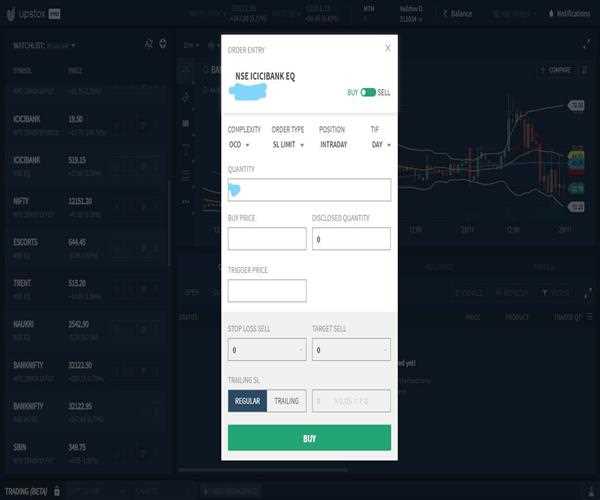

When trading stocks that are highly volatile or trading in a fast-moving market, slippage can be the difference-maker between a profit and loss position. Therefore, understanding trade orders beyond the traditional “buy” and “sell” is very important. There are various types of trade orders which could be exercised to monitor our stock:

- Market Order: used to purchase or sell an order at the current market price. Here, the customer/broker does not control the amount paid for the stock purchase or sale. The market controls the price of the stock. A market order poses a high slippage risk in a fast-moving market. Thus, making it less profitable. For eg, if you place an order for 100 shares, you will receive those 100 shares at the stock's price and not your own price.

- Limit order: it is usually a beneficial order traders. It is used to purchase or sell a stock at a specific set price (set by the trader himself/herself). It is helpful in preventing to buy or sell an order at a price which the trader doesn't want. Therefore, in this type of order, if the market price is not in line with the limit order price, the order will not execute. There are two types of limit orders: buy limit order and sell limit order.

- Stop order: Also referred to as 'stop-loss order' is helpful in preventing any loss of the trader. It sells a stock when it reaches a certain price set by the trader. During the short-term trading, the stock will be purchased if it trades above the stop order price.

- Stop Limit order: it is a conditional trade order that combines the features of a stop and limit order. It requires to place two prices: stop price and limit price. Once the stock hits the stop price, the order becomes a limit order. It guarantees a price limit and also to stop the order at a certain price. For example: a trader wants to buy an order of Rs. 350 under Rs.290 but only if it falls to Rs. 287. He/she sets a stop-limit order by setting a stop price at Rs. 290 and limit price of Rs. 287. Once the stock drops below Rs. 290, then Rs. 287 becomes a limit order.

- Trailing Stop order: It is based on the percentage change in market price as opposed to a specific target price. After applying this order, the stock will be purchased if it increases by a determined percentage. For example, an investor purchases a stock at a price of Rs. 550. He/she puts a trailing stop order of 20%. If the stock declines 20% or more, the order will be executed.

Using these stock market techniques one can easily trade/invest in stocks online without worrying about his/her loss because these functions will monitor the order effectively.